Protected Cell Companies

PCCs, Solvency II and Gibraltar

To the professional involved in captive insurance, Solvency II, the Protected Cell Company (PCC) and Gibraltar will be familiar.

There is an interesting link between these three – the PCC, Solvency II and Gibraltar. Simply put, Solvency II may have the effect of increasing insurance premiums all over Europe, because of higher capital requirements. Gibraltar can be part of the solution to this problem by making available the PCC structure to smaller insurance companies as a means to pool or share the increased capital requirements of Solvency II. The result can be lower premiums and higher profits.

Before I explain this in more detail, first a basic definition of the PCC and Solvency II. The PCC is a limited liability company with the ability to form “cells” that are segregated from each other and from the company. The idea is to ensure that any one cell cannot be affected by the business of another cell, but the cells are not companies in their own right. Solvency II is the proposed capital and regulatory regime to be implemented in the EU from October 2012. It will require insurers to hold enough spare funds (capital) according to the risks the insurer faces – but the amount of spare funds will likely be much greater than at present – especially for smaller insurance companies. A key point about Solvency II is that it rewards companies with a well-diversified portfolio of business, and this can be difficult to achieve for small insurers.

The concept of the PCC can be compared to some historical corporate arrangements. In the forthcoming 2nd edition of the acclaimed book – Protected Cell Companies: a guide to their implementation and use* – authors Feetham and Jones provide us with the insight that Lloyd’s of London is analogous to the PCC. Briefly, the syndicates are like “cells” which contribute to the Central Fund which is like the “core” of the PCC. A PCC can also be compared with the traditions of insurance mutual associations. We have to be clear that the PCC has many uses, one of which is insurance, and a special use for the PCC can be as a mutual (the subject of this article), but this has yet to be properly attempted in Europe.

It is clear that the mutual form (whether within a PCC or not) is inherently difficult to establish. This is because it requires different economic interests to trust each other and share in each other’s success or failure. However, this concept may enjoy a revival due to the extent to which Solvency II is actually frightening the insurance industry in Europe. The capital requirements may become so onerous that a mutual sharing of risks may be the only realistic choice for some to survive. We will now look at this with some real numbers to make things more tangible.

Our starting point is that the cell structure of the PCC can be an efficient way of achieving compliance with a risk-based capital regime such as Solvency II. As mentioned, the cells are not companies, however, the cells enable the separation of assets and liabilities within the single company of the PCC, protected by law. Thus, it is the PCC as a whole that needs to satisfy the risk-based capital requirements of Solvency II, not the cells.

One important difference with this and Solvency I (the existing solvency regime in the EU), is that the solvency requirement under Solvency II will depend on the extent of diversification across the PCC. This means that the extra business from a new cell can reduce the average solvency requirement for all cells. This benefit can be shared between all cells.

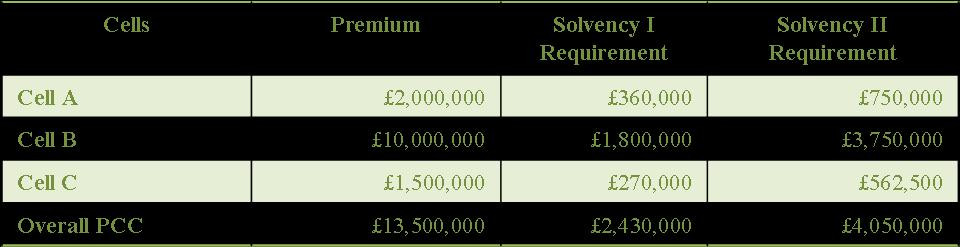

This benefit is perhaps the strongest for small insurers that cannot otherwise meet the Minimum Guarantee Fund requirements, as with Solvency I, however a simplified example below shows how the PCC under Solvency II produces an extra economic benefit (as explained to Feetham and Jones in the afore-mentioned book):

In this very simplified example, we can see that the solvency requirement of the PCC under Solvency I is the sum of the cell requirements, and the benefit of the PCC is that the cells together help to meet the Minimum Guarantee Fund (which varies but let us assume it is £2,300,000 in this example).

However, under Solvency II, the overall solvency requirement of the PCC is less than the sum of each cell’s Solvency II requirement. The exact amount of the discount will depend on a number of factors, but the fact of this discount is not in doubt. This is known as a diversification benefit and its value is equal to £1,012,500 in this example where we apply a 20% discount. The benefit will increase as more cells are formed.

The point to make here is that diversity under Solvency II arises in many different respects. Credit is given for many sources of diversification, some direct and indirect. For example, a company with many reinsurers, many bonds, many bank deposits on the asset side, and many classes of business on the liability side, will gain significant credit under Solvency II. In comparison, a small company with a concentration in these areas will be heavily penalised. The clear point to make is that a collection of small companies can achieve this diversification and the resulting credit or benefit can be shared in part and/or provided to policyholders in the form of lower premiums or better insurance cover.

The ability of a PCC to facilitate this extra saving has not existed before. The combination of the PCC and Solvency II is new development of significance.

If the principle is now established, how can this work in practice? The answer, frankly, is with some difficulty because a mutual is very difficult to establish. However, there are existing mutuals which may be interested in this innovation. Also, as mentioned, some companies are going to fail without joining together in some form. A possible structure and way forward is as follows:

A PCC is launched with permission to write all classes of business to all types of policyholders on the basis that the PCC operates to very strict criteria. Sponsors will be invited to form a cell with minimum capital equivalent to £500k (let us say). Each sponsor will commit to pay into a “Central Fund” levied by the Core as required and with no theoretical limit so that the Core has the means to ensure both regulatory solvency of the PCC and that each cell can meet its contractual liabilities come what may.

Each sponsor will be a limited company so the exposure to the sponsor is limited to the capital injected into the cell. Stringent entry requirements and underwriting oversight would be arranged by the “Core”. The PCC seeks and is given a Rating of “A” by A M Best or equivalent and is managed by a reputable insurance manager.

Most critically, the PCC is secured overall by an overall (or treaty) reinsurance arrangement for two very good reasons. The key issue here (as with any mutual-type arrangement) is the confidence that each sponsor has with regard to the other sponsors. This is hard to do, but the best way to achieve this is by independent verification, and the best way to achieve that is to have a overall treaty reinsurance of the PCC. Thus, the treaty reinsurers are surely motivated to ensure that all the cells are underwritten on a prudent basis, and further, the price of the treaty reinsurance will reflect the risk and this feeds into the charges levied by the Core or “Central Fund”. So what are the two reasons? Simply, the treaty reinsurance protects the PCC and provides confidence (from an independent source) to those that want to form a cell.

Returning to where we started, we have yet to consider the third theme of this article – Gibraltar. The Rock of Gibraltar is still a strategic presence on the southern tip of the Iberian peninsula and it is now a self-governing overseas territory of the UK, and part of the EU with the UK. It is now emerging as one of the leading niche territories in the EU for insurance companies. There are more than 60 licensed entities, and growing. This growth has been spectacular in motor insurance, where Gibraltar now rivals Lloyd’s of London in respect of UK market share. There are companies in Gibraltar which have the ability to access all 30 territories of the EEA/EU on either a Freedom of Services basis or Freedom on Establishment. The combination of an efficient professional infrastructure, effective regulation and access to Europe may continue to drive growth in the insurance sector. We cannot be sure, but Solvency II, and possibly the PCC, may contribute an extra element to this rapid growth for many years to come.

Robin Amos is Assistant Director at Aon Insurance Managers (Gibraltar) Limited, and a member of the GIA’s Solvency II Committee.

*For further reading, see Robin Amos’s review of Nigel Feetham and Grant Jones’ book on PCCs here, and also further information on the book itself here, on the Publisher’s website.

Chris Johnson’s original article on PCCs is here.